The Economic Update: Briefing Note

Hot off the press, InterVISTAS puts the Federal Minister of Finance's Economic Update in a global context. Most of our industry is facing serious disruption due to COVID - just when it is being called upon for vaccine distribution. Are we also undermining our international competitiveness?

Financial Support to Canada’s Aviation Sector

On November 30, 2020, Deputy Primer Minister and Finance Minister Chrystia Freeland provided a fiscal update on the state of federal finances and the Trudeau government’s plans for recovery, including financial support to the aviation sector, as well as the tourism and hospitality industries.

Canadian Airports: Focus on Infrastructure and Regional Connectivity

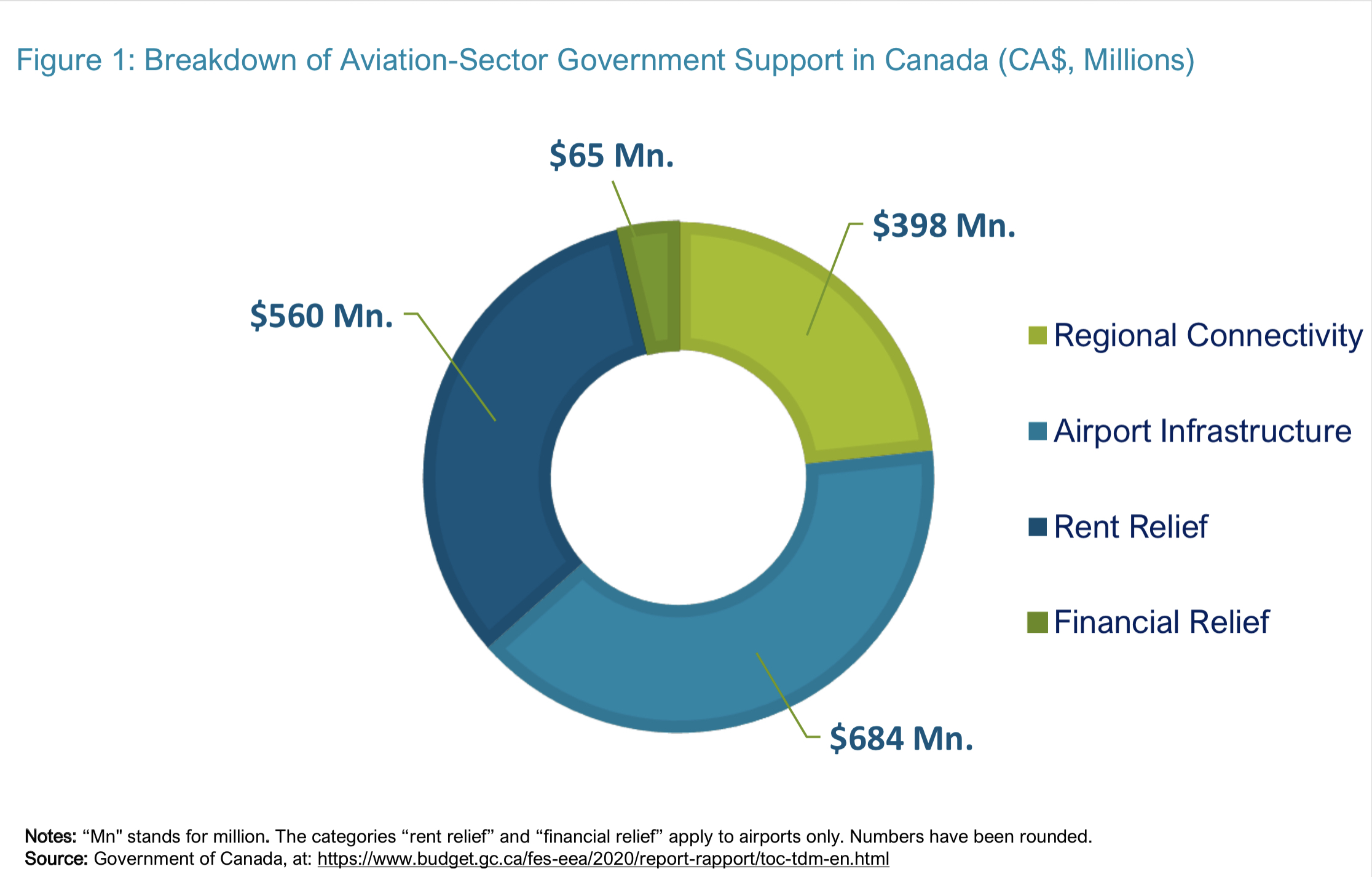

The approach adopted by the federal government in its fiscal update is almost exclusively airport-focused, paying special attention to infrastructure investments and regional connectivity. To date, direct sectoral support to Canada’s aviation sector – either already provided, planned or estimated – equals approximately $1.7 billion. This amount includes funds available for pandemic-related financial relief ($65 million), airport rent relief ($560 million), regional connectivity ($398 million), and airport infrastructure upgrades ($684 million). We note that despite the limited financial impact of the previously-announced rent relief program in the spring of 2020, the government has decided to inject additional funds – some of which are repayable – to this program.

Canadian Airlines: Focus on General Relief Programs

The recent fiscal update refers to “a process with major airlines regarding financial assistance” but does not provide any indication on whether and how such assistance would deviate from the general relief programs approach adopted since the beginning of the pandemic. Canada’s current approach is in sharp contrast with the comprehensive model adopted by the U.S. – which included direct grants, loans, loan guarantees, tax and fee deferrals, wage subsidies – and the firm-level model favoured by major European countries that, like Canada, rely on their airlines for global connectivity and economic recovery (i.e., Germany, France, Netherlands, Norway, Italy).

Similar to the approach presented by the federal government in its most recent fiscal update, other countries such as Australia and New Zealand have also supported their aviation industries through a blend of general relief programs such as wage subsidies, and targeted programs to support infrastructure investments and regional connectivity during post-pandemic recovery.

Australia has provided funding through relief programs such as the Domestic Aviation Network Support Program and the COVID-19 Regional Airline Network Support Program (~ $189 million), as well as the Regional Airlines Funding Assistance Program (~$96 million). Moreover, as part of the Australian Airline Financial Relief Package (~$684 million), grants are made available to ease operational costs associated with providing domestic commercial air services. Australia has also provided support for regional airport operators to implement security screening infrastructures. New Zealand has introduced the Essential Transport Connectivity Scheme (~$27 million) as part of its stimulus package, which is designed to ensure that capacity, regional connectivity, and essential services continue throughout the country in the wake of COVID-19.

The Canadian Model: Potential Implication

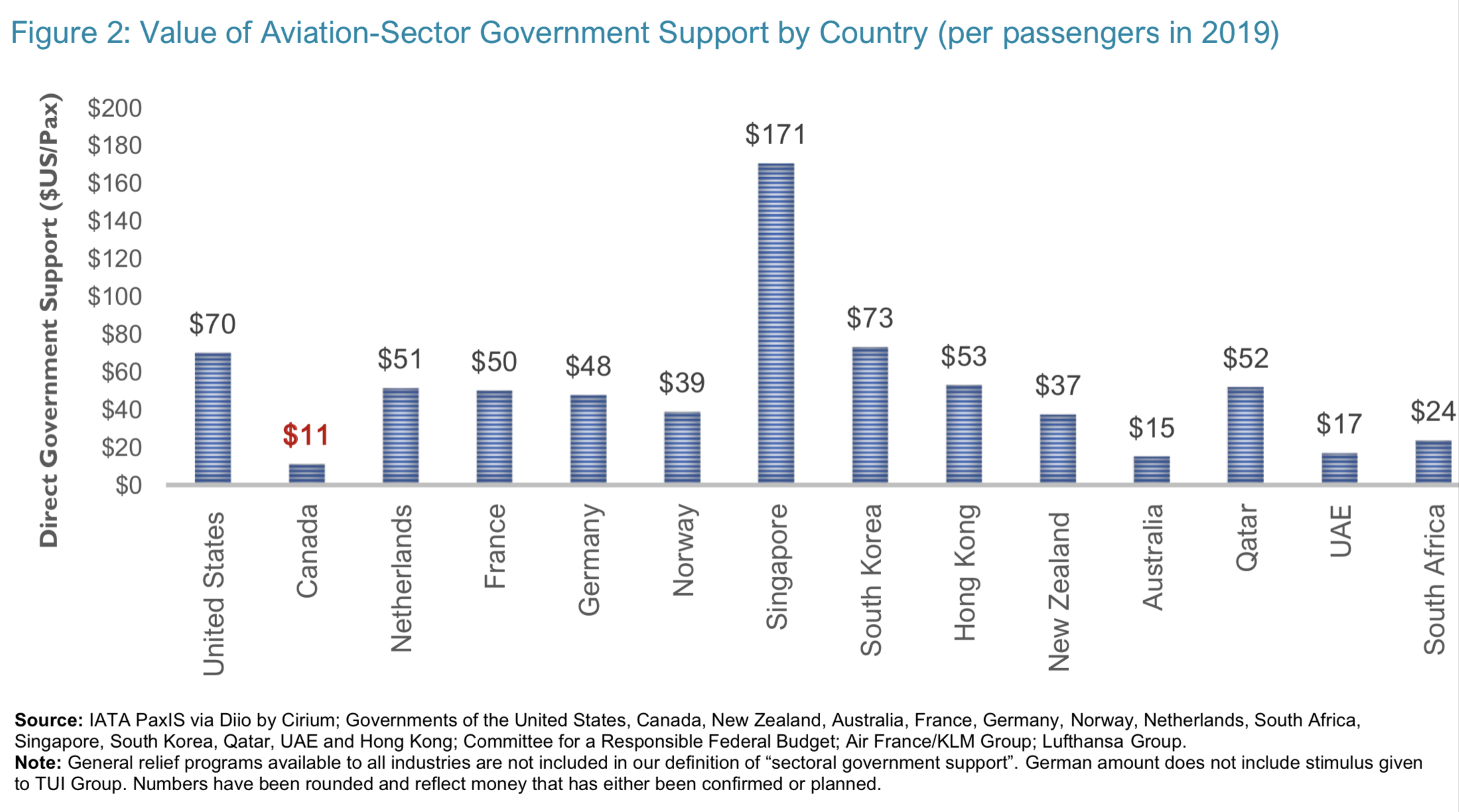

The magnitude of government support to the aviation sector continues to vary across countries and regions. As illustrated in Figure 2 above, the total value of direct government support (per number of passengers in 2019) tends to oscillate between US$11 and US$73. Singapore is a notable outlier, with its government providing over US$170 of direct aviation-specific support per passenger. This certainly underscores the importance of the aviation sector as an enabler for business and tourism activities within the city-state, but also the key role that Singapore Airlines plays as a catalyst for economic recovery and global connectivity.

As we enter the second phase of recovery, sustained discrepancies in levels of government support have not only the potential to affect the financial viability of airlines, but also the global competitiveness of the whole aviation sector, including related industries such as tourism and hospitality. These regional disparities will likely impact the competitive dynamics in international markets where Canadian airlines will be soon competing for overlapping traffic flows, particularly on the North America-Asia and North America-Europe markets. Losing ground in these markets in 2021-22 may end up affecting the number of international passengers arriving and/or transiting at major Canadian hubs once quarantine requirements are lifted by the federal government, potentially slowing down the long-term recovery of the whole Canadian aviation sector.

Conclusion

This week’s fiscal update presented, in unequivocal terms, Canada’s policy approach to direct financial support for aviation: main focus on airport infrastructure and regional connectivity, reliance on general relief programs such as wage subsidies, and the emergence of certain conditionalities such as refunds for cancelled flights. Going forward, some questions remain open. For example, which governance model will the federal government favour for the implementation of the Regional Air Transportation Initiative (i.e., direct transfers to airlines/airports or route-based support)? How much will airport charges need to increase in the coming years in order to cover repayment of rents at large airports? How much effect will this have in de-stimulating air travel, tourism, commerce, social connectivity? Finally, will municipally-owned airports become eligible for emergency loans like airports with other governance models?

The complete briefing memo is attached to this eNewsletter.

Government Programs Required to Mitigate the Impact of COVID-19 at British Columbia’s Municipal Airports

Briefing note from Sam Samaddar, Airport Director, Kelowna International Airport, focussing on the terrible impact COVID-19 has had on regional airports - especially Municipal Airports.

With passenger numbers remaining at historic lows and travel restrictions continuing for the foreseeable future, Canada’s airports have renewed their call for urgent government relief.

October 2020 passenger volumes were 85.5 percent lower overall compared with October 2019. By sector, domestic travel was down by 79.2 percent, U.S. transborder traffic by 95.9 percent and other international traffic by 91.3 percent. This is a continuation of a nine-month long trend. Since April, traffic has been down by 90 percent over the same period in 2019.

Unlike many other countries, the majority of Canadian airports are not subsidized by government. They rely on revenues generated by passenger air travel. All of the services they provide, such as passenger facilitation, operations and emergency services like firefighting or humanitarian relief, are paid for by users. But with virtually no users and no revenue, the system has broken down.

The health and safety of our passengers and workers is our number one priority, without exception or compromise. Despite financial difficulties, airports continue to maintain operations, emergency services and enhanced safety and health protocols even as passengers have disappeared and air carriers have begun to cancel important regional routes. If the government does not act to support these national assets immediately, there could be serious consequences not only for travellers, but for communities as well.

As travel restrictions and quarantines drag on into the fall and winter, an updated financial outlook paints a dire picture for Canada’s airports, which now expect to incur more than $4.5 billion in lost revenue and debt levels increasing by $2.8 billion before the end of 2021. A revised outlook, which represents a 30 per cent deterioration in expectations, was recently submitted to the federal government.

Here in British Columbia regional scheduled services are decimated – with several small, remote and Indigenous communities losing substantial scheduled services. The effects are devastating.

Regional airports such as Kelowna International Airport generate opportunities for high-value tourism, trade and development, especially for smaller destinations. YLW is a pillar in the region supporting economic growth. Guests from all around the world use the airport as their gateway to experience world class, four-season recreation and tourism amenities. Residents also use YLW as the gateway to the world, connecting via Vancouver, Calgary, Toronto and other major hubs.

YLW is one of the single largest economic drivers for jobs and revenues in British Columbia’s southern region. YLW’s total economic impact is 4,545 jobs and $789 million in total economic output to the province of B.C. Organizations based at YLW directly produce over $152 million in GDP. In 2019, YLW was the 10th busiest airport in Canada by passenger volume and the second busiest airport in British Columbia.

The increased demand generated by regional services boost airlines’ ability to fly to many destinations and supports the viability of Canada’s entire air transportation system. Passenger revenues also help fund essential services that communities rely on, such as medevac, firefighting, and delivering emergency personnel and goods. But today, those revenues are no longer there to support these services.

YLW is the largest Municipal airport in Canada and the only National Airport that is not an airport authority. As a consequence, many of the federal government programs that have been announced to provide financial relief due to the COVID-19 pandemic, such as the Canada Emergency Wage Subsidy (CEWS), have not been made available to airports like Kelowna because we are a municipal entity and therefore not eligible for the funding.

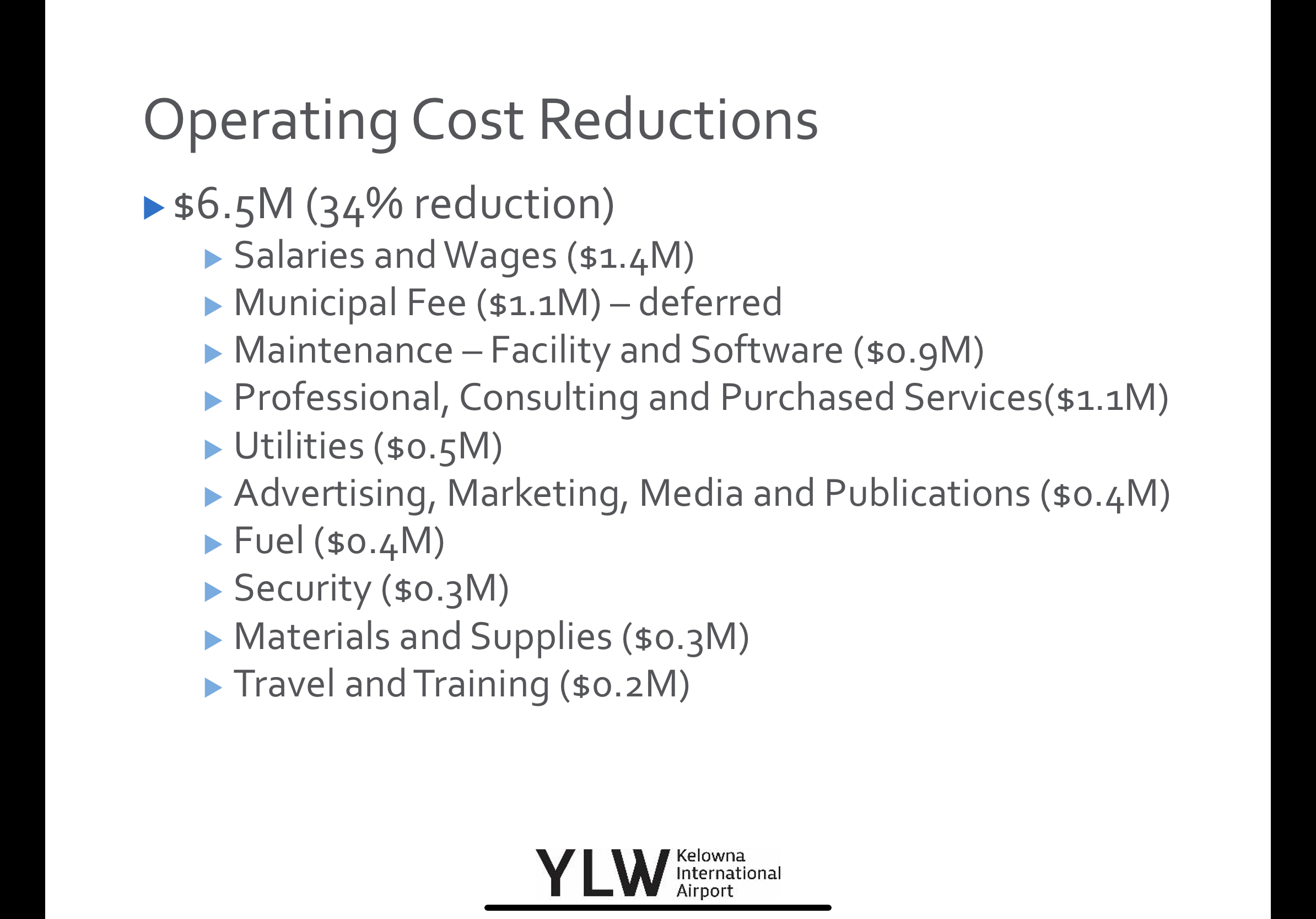

As a result, YLW has taken drastic measures in reducing expenditures through layoffs, suspending capital investments by $22 million (79 per cent) and is projected to spend $4.6 million from its reserves in 2020. The outlook for 2021 is not much better and YLW estimates a further loss of $4.8 million.

Our sector has largely operated without subsidies since privatization. Airports even delivered a financial return to governments: about $6.5 billion in rent in addition to property taxes paid. Due to COVID-19, that system is breaking down. Until now, user fees have been set at a level that pays for passengers’ services and allows for capital improvements that enhance the travel experience and increase flight options.

As a matter of urgency, YLW is asking the governments of Canada and British Columbia for several immediate relief measures.

1. Provide immediate financial support to cover operating costs and alleviate the need for rate increases.

2. Invest in air transportation infrastructure programs that will support economic recovery to help airports like YLW adapt to COVID-19.

3. Ensure sustainable recovery at our regional airports.

4. At the right time implement measures to stimulate domestic and international air travel to promote recovery in the tourism sector.

With traffic down by almost three quarters in 2020 and forecasted to be down by two-thirds in 2021, airports’ financial situations are literally getting worse by the day. Without immediate government relief we are not sure what kind of air transport sector will be left for British Columbians when they are ready to travel again.

Attached is a full copy of this briefing note and a PowerPoint providing the financial details and actions Kelowna International Airport has undertaken to mitigate its operating and capital costs.

Today, Tuesday, 11am Pacific Webinar: Paths to Recovery: Testing and Vaccination for Safe Restart of Air Travel

Because we are all looking for light at the end of this very dark Coronavirus tunnel, a comprehensive webinar has been facilitated by the Futures Border Coalition (the BCAC is an active coalition member). Register now - as of Friday there were 220 delegates.

We would like to invite you to our upcoming Canadian government-industry webinar “Paths to Recovery: Testing and Vaccination for Safe Restart of Air Travel,” in partnership with the National Airlines Council of Canada and the Canadian Airports Council.

This event brings together a group of senior government officials and seasoned industry executives to discuss policy solutions for recovery and identify concrete steps to restore public confidence in air travel. Health preclearance, testing protocols, entry requirements, vaccines, immunity passports and reduction/elimination of quarantine requirements will be reviewed along with the economic and social benefits of travel resumption.

Date: Tuesday, December 8th, 2020

Time: 11:00 a.m. – 1:15 p.m. PST (2:00 p.m. – 4:15 p.m. EST)

Location: Online (Zoom link to be sent after RSVP)

We invite you to RSVP via evite at the following link: http://evite.me/PuBRyszygu

Sincerely,

Gerry Bruno, Co-Chair, Executive Director, Future Borders Coalition

Matt Morrison, Co-Chair, Future Borders Coalition

CCAA Labour Forum Dec 10th, 10am Pacific CCAA Labour Forum Dec 10th, 10am Pacific

Get the latest Canadian aviation and aerospace labour market update, not just from a national perspective but from regional perspectives as well. The British Columbia situation will be presented by our BC Aviation Council Chair, Heather Bell.

Join your industry colleagues in attending the virtual 2020 CCAA Labour Market Strategy Forum (#CCAAForum) on December 10, 2020.

COVID 19 has been hard on Canada’s aviation and aerospace sector, both in terms of business and the workforce. And with promising vaccines in the works and almost a year’s worth of experience operating in a pandemic environment, is getting back to business, and starting on the road to recovery a possibility? What will the recovery in the workplace and for the workforce look like? Is the industry ready? Are you?

The CCAA Forum is a free 3-hour event featuring a panel of the Regional Associations (BCAC, Manitoba Aerospace, Ontario Aerospace Council, CAMAQ and ACADA) followed by a panel of the National Associations (AIAC ATAC, HAC, and CBAA). Experts will discuss the impact of the pandemic on Canada’s aviation and aerospace workforce, and what we need to do as an industry to prepare for the recovery from a labour and skills perspective.

National Panel

Robert Donald, CCAA’s Executive Director will moderate a discussion panel that takes a look at the future of the skilled aviation and aerospace workforce in a post-covid world. Panelists include Mike Mueller, Senior Vice President, AIAC; John McKenna, President and CEO, ATAC; Fred Jones, President and CEO, HAC; and Anthony Norejko, President and CEO, CBAA. (CAC invited.)

Regional Panel

Theresa Davis-Woodhouse, CCAA’s Senior Director of Project Management, moderates this panel on regional perspectives in navigating labour and training challenges beyond Covid.

The panel will share their insights on the effects of the pandemic in the workplace and how companies in their regions are trying to adapt to – and survive – a very challenging situation.

Panelists Carole Lee Reinhardt, President & CEO, Atlantic Canada Aerospace and Defence Association; Heather Bell, Chair, British Columbia Aviation Council; Nathalie Paré, Directrice Générale, Comité sectoriel de main-d'oeuvre en aérospatiale du Québec; Wendell C. Wiebe, Chief Executive Officer, Manitoba Aerospace; and Moira Harvey, Executive Director, Ontario Aerospace Council.

Sign up for email updates about the CCAA Forum 2020 here.

Help inform our industry by taking the quick Impacts of Covid & Recovery survey here.

Registered attendees will receive the Forum Agenda and Attendee link by email prior to December 10th.

|